A flood insurance rate map firm is an official map on which fema has delineated special flood hazard area sfhas applicable to the community.

Flood zone ae rates 2020.

Sfhas are labeled as zone a zone ao zone ah zones a1 a30 zone ae zone a99 zone ar zone ar ae zone ar ao zone ar a1 a30 zone ar a zone v zone ve and zones v1 v30.

The three flood prone states of louisiana texas and louisiana were among the most affordable places to find nfip coverage.

To purchase flood insurance call your insurance company or insurance agent the same person who sells your home or auto insurance.

These are generally because most of the structures have a negative base flood elevation.

Well there are a few things that have a major impact on flood premiums in these zones.

High risk areas zone a a high risk flood zone also known as a special flood hazard area sfha are regions that face at least a 1 chance of flooding annually and a 25 chance of flooding.

This area is more commonly referred to as the base flood area or the 100 year flood plain.

Plan ahead as there is typically a 30 day waiting period for an nfip policy to go into effect unless the coverage is mandated it is purchased as required by a.

The 1 percent annual chance flood is also referred to as the base flood or 100 year flood.

As part of its risk map effort fema scientists and engineers work with other federal state regional community tribal non profit nongovernmental and private sector partners to determine the flood risk for properties along the populated u s.

If you need help finding a provider go to floodsmart gov find or call the nfip at 877 336 2627.

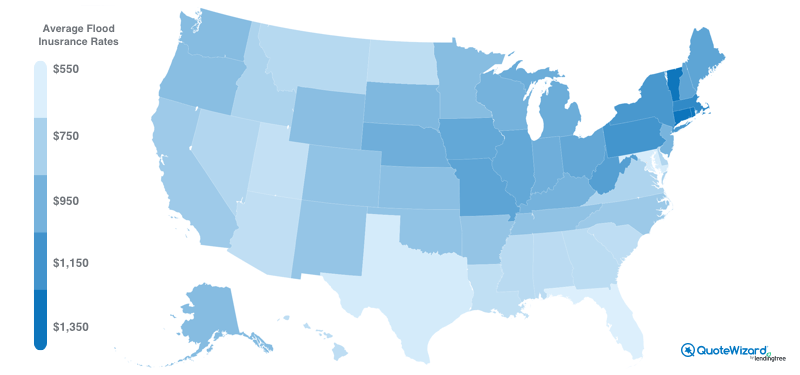

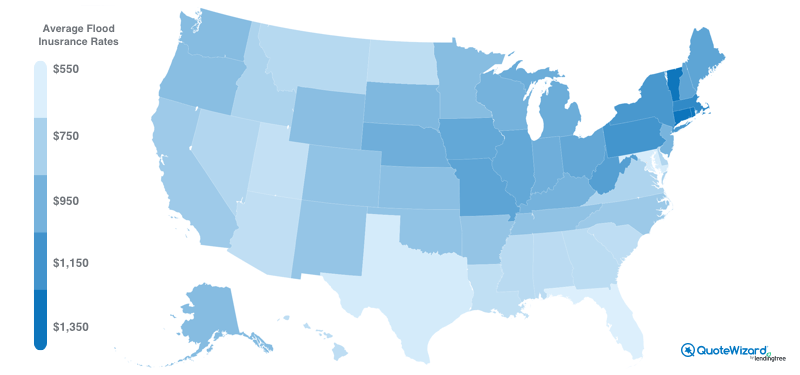

Costs by state come down to the amount of flood coverage homeowners receive on their policies which can be in part determined by flood zones.

The nfip goes through periodic congressional reauthorization to renew the nfip s statutory authority to operate.

Since the inception of nfip additional legislation has been enacted.

Flood zone ae also referred to as the 100 year flood zone has the highest premiums other than coastal areas.

Congress established the national flood insurance program nfip with the passage of the national flood insurance act of 1968.

The figures below are for flood insurance policies through the nfip which according to a study by the university of pennsylvania accounts for between 96 and 97 of all residential flood insurance policies.

So what determines the premiums of these zones.

Florida enjoys the cheapest flood insurance rates of 550 a year while connecticut has the most expensive average rates at 1 395 a year.

Fema maintains and updates data through flood maps and risk assessments.

Flood mapping is an important part of the national flood insurance program nfip as it is the basis of the nfip regulations and flood insurance requirements.

Because flood zone ae is prone to flood property owners with mortgages from federally regulated lenders in these zones must buy flood insurance if they live in a community that participates in the national flood insurance program nfip.